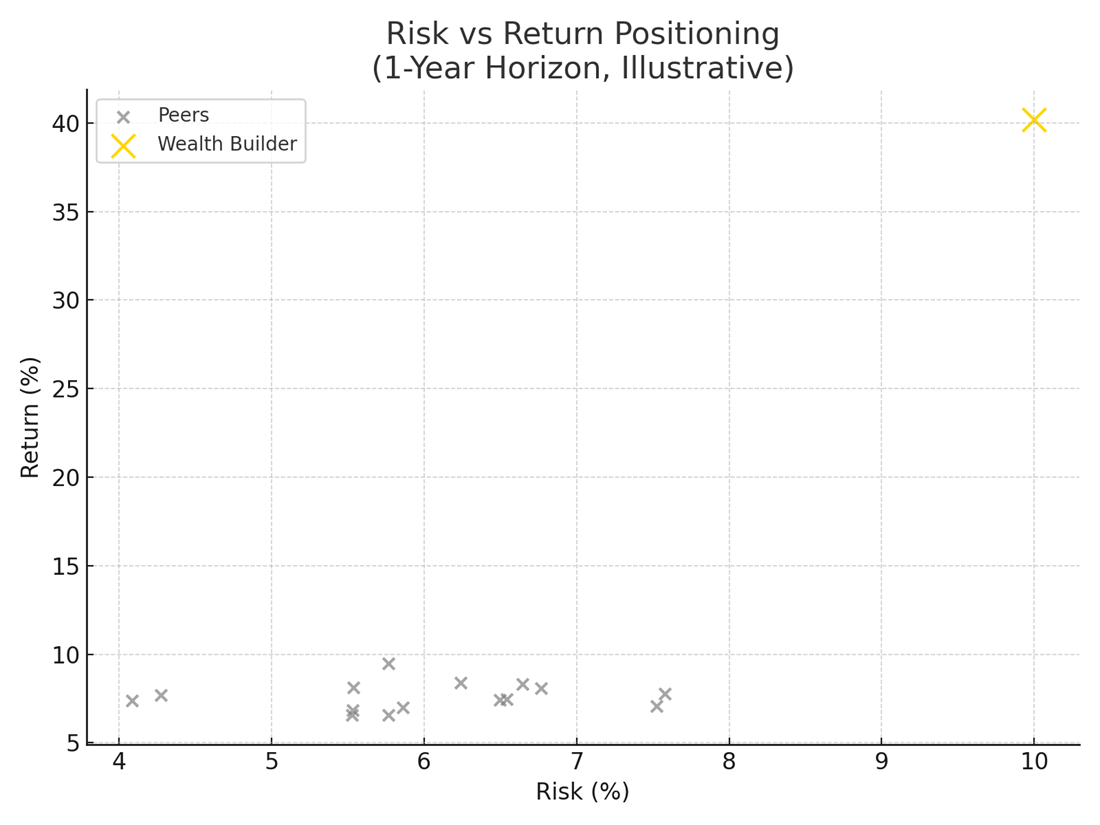

In today’s complex market environment, the choice of investment approach is more than just a portfolio decision - it’s a business-defining one. For financial planning firms and dealer groups, the investment philosophy they choose to work with can either strengthen their client relationships or quietly undermine them.

Advisers know that the risks of following an outdated investment approach, or one that may not work well in these times, extends well beyond poor portfolio performance. They can ripple into client trust, business reputation, compliance risk, and long-term commercial sustainability.