Successful financial advisers require a rare mix of technical and interpersonal skills. A significant part of the client experience is created by how you structure engagement to ensure a positive client journey. One that is empathetic, informative, understood, and pinpoint-focused on their unique circumstances.

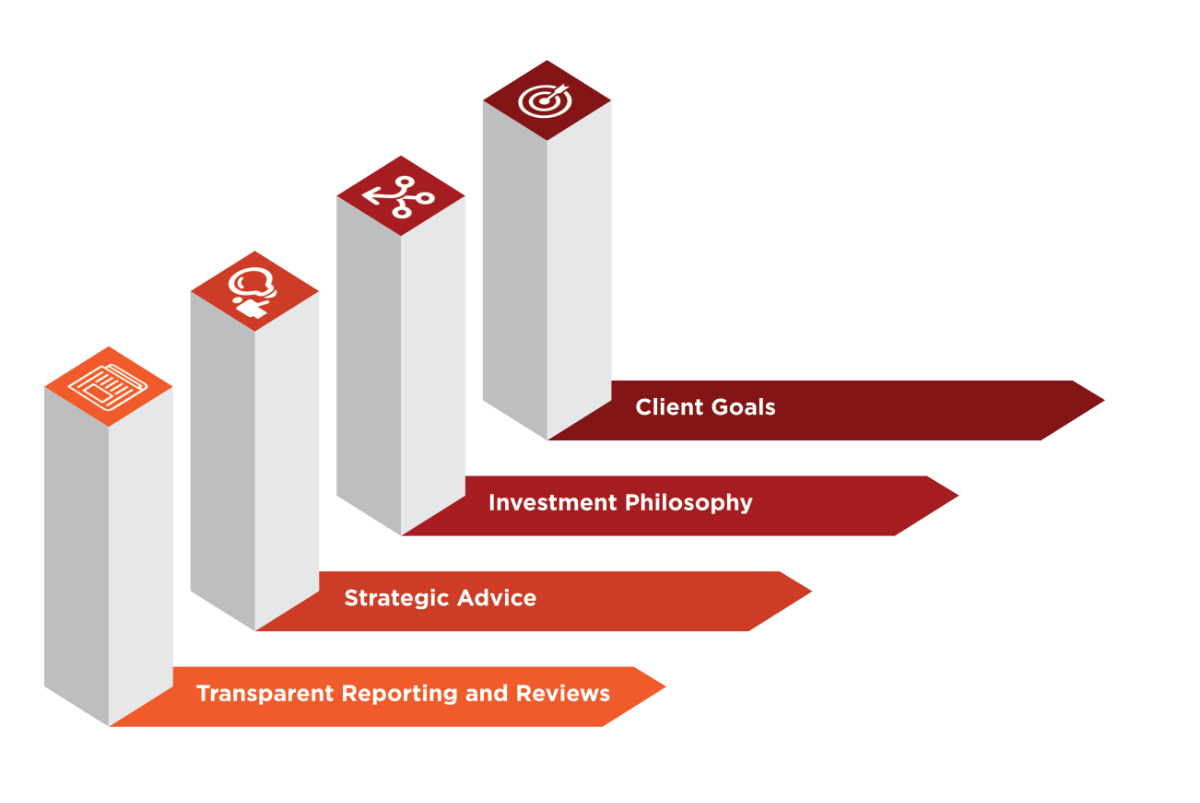

Strategic frameworks can help you form an excellent foundation for business development. A strategic framework typically includes several critical pillars to which you attach your compelling points of difference. The framework provides a simple guide to focus your business development and helps you position your business to new clients and make it essential for existing clients.This article discusses a strategic framework that will help advisers develop high levels of client satisfaction.

The pillars of client satisfaction

The Financial Planner client satisfaction framework features four strategic pillars:

- Client goals

- Investment philosophy

- Strategic advice

- Transparent reporting and reviews

Client Goals

In today's hyper-competitive markets, every successful business must be customer or client-centric. That is, to be aligned with and deliver outcomes that clients want. Consistent with that is understanding and agreeing on client goals, which are, of course, the key to the success of every contemporary financial adviser. Establishing client goals forms the adviser's knowledge of the client's circumstances, who they are and where they're heading.

While informative for the adviser, the process makes the client feel heard and understood. Better still, it holds the promise of advice that matches the unique circumstances and ambitions of every client – itself the foundation of client's best interest obligations. A genuinely encompassing approach to setting client goals goes well beyond simply undertaking an assessment of risk tolerance.

While circumstances and goals can change, setting realistic goals is something every client can understand and own as an investment trajectory. Goals help advisers manage the complexities of investor psychology and overcome behavioural biases that often work against positive investment outcomes.

Investment Philosophy

Many of the world's leading investors will tell you that nothing is more critical to long-term investment success than a clear investment philosophy.

An investment philosophy is based on your intractable belief in the principles and practices that guide your decision-making. In times of market upheaval and through the dark of uncertainty, your investment philosophy enables you to control your emotions, shut out the noise and focus on the things that matter over the long term.

It is also a positioning point for your value proposition to clients, as well as defining the technical aspects of investing. People are attracted to brands that demonstrate a belief system that aligns with their own. It's a vital part of attracting the best-fit clients to your business.

The only real way to precisely match client goals with targeted investment outcomes is to use a Dynamic Asset Allocation (DAA) approach. That is because portfolios that employ DAA specifically target the defined risk-return outcomes over specified periods that the clients seek. To execute effectively, DAA portfolios typically contain a broader range of more diversified asset classes that enable them to focus on the forward-looking risk and return of specific assets. It's different to the typical SAA portfolio, which develops portfolios based on the historical performance of asset classes in a more pre-determined and fixed set of asset classes and ranges. For example, the Future Fund has been vocal in its advocacy for portfolio management that adapts to the changing future of the investment landscape.

Using DAA portfolios hard-wires the client-centricity of your business by precisely matching investments to goals. DAA portfolios are best managed by specialist portfolio managers with the time and resources available to manage portfolios in real time. The added benefit is the freeing of adviser time to focus on their clients, helping further with client satisfaction.

Strategic Advice Focus

The data is clear concerning the drivers of profitability for financial advisers. Those that focus on holistic strategic advice consistently outperform financial planners that focus on investment execution alone.

The 'Value of Time' report by the technology and investment business, SEI, found that businesses that focus on holistic strategic advice:

- Attracted three and a half times more new clients per year

- Had a 67% greater growth in FUM per annum

- Attained a 132% higher growth in business value over ten years

These facts clearly describe why advisers are trending more toward partnering with managers to provide specialist investment services while focusing more on strategic advice. The execution of this approach also explains why funds under management are snowballing for managed accounts and the use of client-centric actively-managed DAA portfolios for retail investments.

Transparent Reporting and Reviews

Retaining clients' trust through economic and market cycles is not for the faint-hearted. Transparency and understanding are essential. Because today's investor has ready access to so much information, clarity and context are vital to retaining client trust.

The old way was to try and keep things calm by "staying the course", believing that the cycles will return asset classes to their historical norms. While that may be true over 30-year timeframes, most valuable clients don't have that much time.

Maintaining focus on the trajectory towards a client's goals is a much more positive and readily understandable context in which to review results. Plus, focusing on goals that match actively managed DAA portfolios will likely result in lower levels of volatility and client anxiety in challenging times.

See related article: What to expect from Goals Based Investing.

This article has proposed The Client Satisfaction Framework as a strategic framework for advisers. It focuses on four mutually beneficial and interdependent pillars – client goals, investment philosophy, strategic advice and transparent reporting and reviews.

Dynamic Asset can deliver turn-key solutions for advisers to help meet all four pillars of client satisfaction. Contact us to learn more about how Dynamic Asset can help you to model your business for client satisfaction, profitability and success.