The idea that we should invest to meet our needs and goals is basic common sense. However, somewhat surprisingly, that is not what most players within the investment industry do.

The most prevalent approach is to build investments with reference to a 'benchmark' such as shares, property or fixed interest – and the many derivations thereof. Diversified portfolios are then built using Modern Portfolio Theory, based on the assumptions of the Efficient Market Hypothesis, to create an 'optimal' Strategic Asset Allocation (SAA) to match a Risk Profile. Your stated risk profile then determines your investment allocation.

It is all good theory, but unfortunately, the real world doesn't always work that way. Markets are not always efficient and predictable, and past behaviour does not necessarily reflect future behaviour.

Then, there is a question about whether the idea of how someone 'feels' about their investments will perfectly match what they 'need' to achieve their stated goals. In practice, they rarely match up. While it's essential to understand and respect someone's risk tolerance, the reality is that using a risk profile to guide the design of portfolios is almost guaranteed NOT to meet your needs.

Goals Based Investing is a simple, rational approach to building portfolios that specifically targets meeting known needs - so long as they are reasonable. It's far more intuitive to understand why you are investing. It helps overcome behavioural finance issues and address technical and strategic challenges such as sequencing risk and income/cash flow planning in retirement.

While the WHY can be readily understood, there are some fundamental differences in HOW Goals Based Investing differs from traditional SAA investing. Typically, the main differences are:

- There are much broader asset allocation ranges, allowing a Goals Based Investing (GBI) manager greater flexibility in what asset classes and investments they can invest into

- GBI portfolios generally have a greater ability to allocate to alternative asset classes or investment strategies such as equity long/short, infrastructure, commodities (soft and hard), CTA and global macro

- To try to meet objectives through a cycle, GBI managers will use Dynamic Asset Allocation (DAA) to invest only in assets they believe will achieve their goals at a particular point in time

- Given GBI investments' more defined investment objectives, there is a much greater focus on asset classes' risk (volatility). The aim is to limit the extent and severity of loss of capital value. As a result, GBI portfolios exhibit a strong focus on capital protection

- GBI portfolios generally do not benchmark against traditional markets, such as shares and property, which can be volatile and have little relevance to investors' desired outcomes.

Due to these differences, the skillset required to build and manage a Goals Based Investment portfolio differs from traditional managers. In fact, given the history and current status quo of investment managers, it's not easy to identify high-quality 'true to label' Goals Based Investment managers. Some managers hold themselves up to be Goals Based Investment managers, but that may be more marketing than substance. When identifying a Goals Based Investment solution that meets your needs, care is required.

If you are interested in Goals Based Investing, because it makes good sense, it's essential to understand what to expect from Goals Based Investing. With a different approach comes different outcomes.

Firstly, it's essential to understand what NOT to expect from Goals Based Investing. Just because you 'target' an outcome doesn't mean it is 'guaranteed'. All investment involves risk regardless of how you do it. You will still experience volatility of your capital. Your investments will still go up – and down. The trajectory or investment results will not follow a straight line month after month. The 'target' is the result to be achieved over the stated investment timeframe, be it short or long-term.

There are, however, specific attributes that you CAN expect from Goals Based investing.

Primary amongst these is that if you are targeting specific outcomes and managing diligently to that purpose, then you should expect a higher probability of achieving that outcome than an approach like SAA may deliver at any particular point in time. If it improves the likelihood of you achieving your goals, then that in itself is a good thing, as it can help provide some peace of mind.

You should expect less volatility and a greater degree of capital protection.

There are two crucial points to bear in mind. Numerous surveys point to the fact that the top priorities for investors are (1) peace of mind and (2) protection of capital.

Finally, investing in a diversified Goals Based Investment portfolio will not behave like traditional markets or benchmarks. Market outcomes become irrelevant as they likely have little to do with the targeted result. For example, if you have a CPI + 5% target return, then does it matter what the share market does?

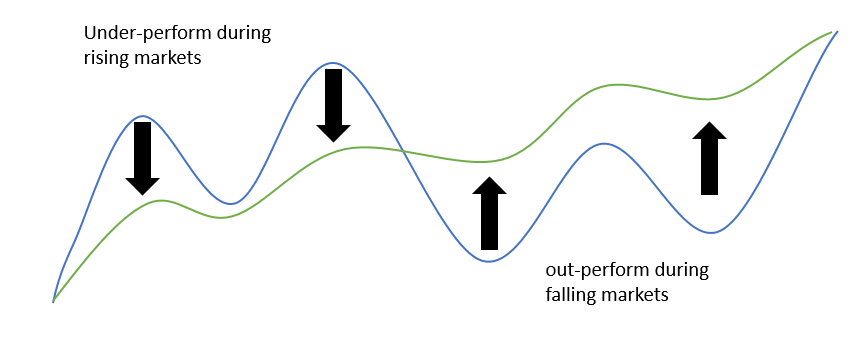

In summary, you should expect a Goals Based Investment with lower volatility to under-perform during a rising market and to outperform during a falling market.

Not surprisingly, Goals Based Investing is gaining understanding and acceptance among financial planners and investors. The reasons are obvious and straightforward; they make sense, provide more reliable outcomes and can be easily applied to specific investor goals and circumstances.

Goals Based Investing goes hand-in-hand with the philosophy of Total Portfolio Management.

Goals Based Investment managers, such as Dynamic Asset Consulting, have built and are managing 'true to label' Goals Based Investment portfolios, applied as an end-to-end managed account solution for advice businesses.

To understand more about Goals Based Investing and how it can help you achieve your financial goals, contact Dynamic Asset today, or talk to your financial adviser.