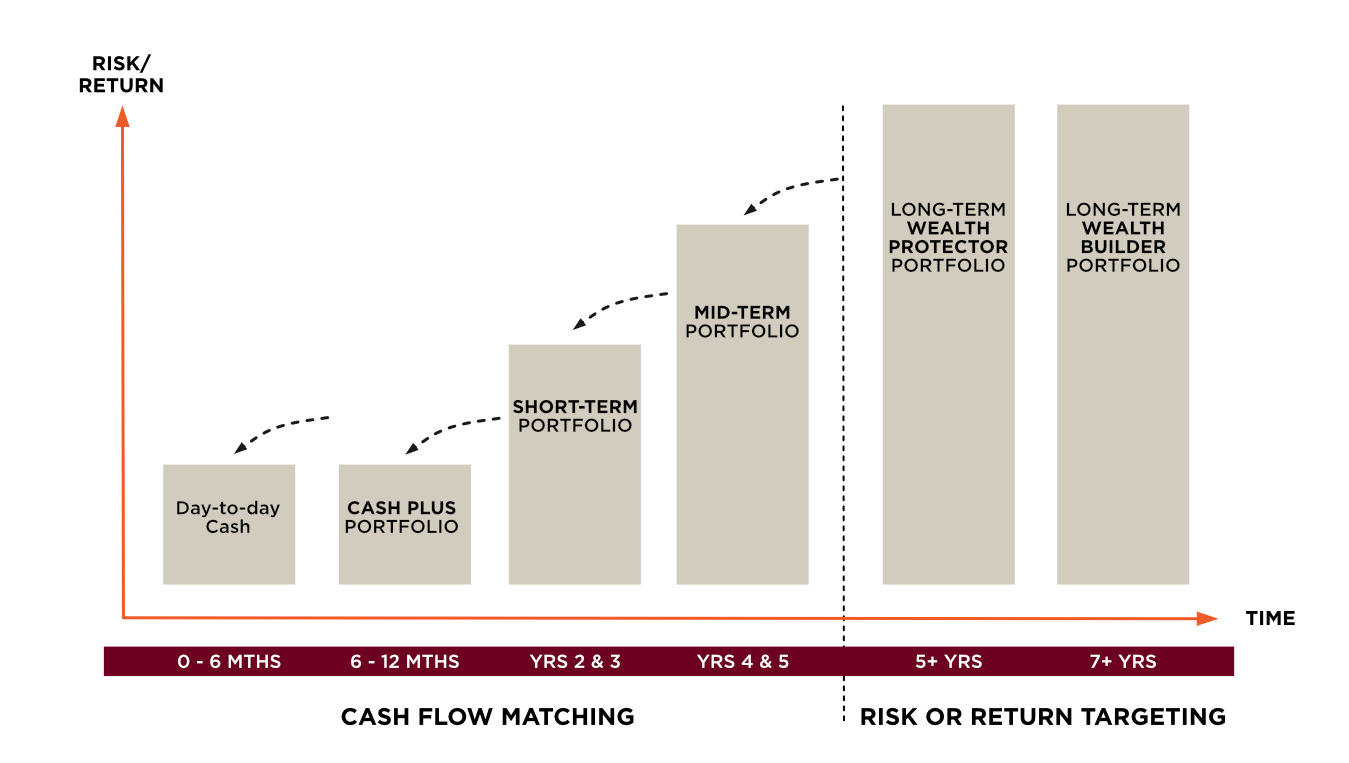

The Cash Plus Portfolio is a cash flow/liquidity orientated portfolio constructed with the aim of providing for capital or liquidity requirements between 3 and 12 months.

It uses a range of more defensively orientated, short-dated investments that aim to provide cash ‘plus’ or Term Deposit levels of income with minimal volatility.

The goals of the Cash Plus Portfolio are:

USES

Investors often want to hold cash aside as a buffer for emergencies or to cover expenses they know are coming up shortly. They may want a slightly higher return than leaving the money in the bank without the inconvenience of rolling over Term Deposits or opening online savings accounts.

The Short-Term Portfolio is a cash flow/liquidity orientated portfolio which aims to provide for capital or liquidity requirements between 12 months and three years.

It uses a limited range of lower volatility assets that aim to provide a higher level of income relative to Cash-Plus with low levels of growth and minimal volatility.

The goals of the Short-Term Portfolio are:

USES

The Short-Term Portfolio is generally used to provide for known cash flow needs and capital security over the next 1 to 3 years.

The Mid-Term Portfolio is a cash flow/liquidity based portfolio which aims to provide for capital or liquidity requirements between 3 to 5 years.

It uses a broader mix of investments that aims to provide a moderate level of income and growth with low levels of volatility.

The goals of the Mid-Term Portfolio are:

USES

The Mid-Term Portfolio is generally used to provide for known cash flow needs and availability over the next 3 to 5 years.

The Long-Term Wealth Protector Portfolio is a risk/return based portfolio that aims to protect the value of capital using a mix of predominantly defensive and alternative investments, although it may hold growth assets if deemed appropriate.

The aim is to provide a reasonable income stream with some capital growth and moderate levels of volatility.

The goals of the Long-Term Wealth Protector Portfolio are:

USES

The Long-Term Wealth Protector Portfolio is generally used to hold longer-term investments and limit exposure to risk.

The Long-Term Wealth Builder Portfolio is a risk/return based portfolio that aims to build the value of capital using a mix of predominate growth and alternative investments.

The aim is to provide mostly capital growth with some income and will experience higher levels of volatility relevant to other Dynamic Asset

The goals of the Long-Term Wealth Builder Portfolio are:

USES

The Long-Term Wealth Builder portfolio is typically used by younger investors that have a long-term investment horizon, such as in their super, for investors that need higher returns to help meet their needs or for investors that want to borrow and invest in a portfolio that provides enough of a margin to justify the additional risk.

Your financial advisor can use Dynamic Asset portfolios in a similar way that they typically choose a range of managed funds, shares or property to appropriately balance the risk and return of your investments.

Advisers often use a mix of Dynamic Asset portfolios to match investments directly to your circumstances and goals. This makes the process clearer and more personal.

Instead of overwhelming you with a long list of complicated investments, your adviser can focus on what really matters - understanding your needs and what you want to achive at different points in your life.

Then, our active goals-based management comes into play. Together with your adviser you can blend different portfolios to suit each goal helping you increase the likelihood of achieving your goals while managing risk more effectively. You’ll gain greater understanding about why you hold certain investments and how they’re helping you progress.

The result is clarity, confidence, and peace of mind - less stress, more satisfaction, and a clear path to the future you want.

Dynamic Asset Consulting Pty Limited (ABN 67164 408 191) AFS Licence No: 502623. © Copyright 2018 by Dynamic Asset Consulting Pty Limited - All rights reserved. No reprinting, publication, extracting of copy or any other redistribution of this website content is permissible without the prior consent of Dynamic Asset Consulting Pty Limited.