For decades, retail investors have been handed the same investment framework: static strategic asset allocation, risk profiles labelled “conservative,” “balanced,” or “growth,” and the assumption that history always repeats. That framework worked in the disinflationary decades of falling rates and globalisation — but today it looks fragile.

Inflation is sticky. Growth is slowing. Debt is piling up. Geopolitical tensions and currency debasement are front-page news. Investors can no longer afford to rely on old rules of thumb.

That’s why we built Dynamic Asset — to change the playbook.

Why We Started with a Different Philosophy

At our core is Goals Based Investing (GBI). Unlike traditional approaches that begin with psychometric “risk tolerance” and asset-class silos, GBI starts with real investor goals: meeting cash flow needs, achieving returns above inflation, and managing drawdowns to protect capital.

That is why we incorporated Dynamic Asset Allocation (DAA). Markets don’t move in straight lines, and investors can’t wait for “mean reversion.” By adapting portfolios dynamically, we can capture opportunities or protect against risks as conditions change — whether that’s inflation shocks, stagflation, or liquidity squeezes.

This philosophy gives us the flexibility to use the full toolkit — equities, bonds, currencies, real assets, alternatives — without being tethered to benchmarks.

A Better Way for Retail Investors

Institutions like the Future Fund, Harvard, and Yale have long invested this way. Yet retail investors were largely left with rigid, benchmark-tracking portfolios. We believed there had to be a better way — and we built it.

Our approach means:

- Resilience in inflationary or stagflationary regimes.

- Protection against currency debasement through gold and real assets.

- Selective growth in technology and AI themes — but deeper in the value chain, where valuations are more rational.

- Flexibility to avoid over-crowded trades (like U.S. megacaps at stretched multiples).

Proof in the Pudding

This isn’t just theory. Over the past year, our portfolios have delivered exceptional results:

- Wealth Builder: +40.2%

- Wealth Protector: +25.6%

We achieved this not by chasing benchmarks, but by adopting the right approach for the times - a philosophy built for today’s volatile, uncertain world.

The Difference

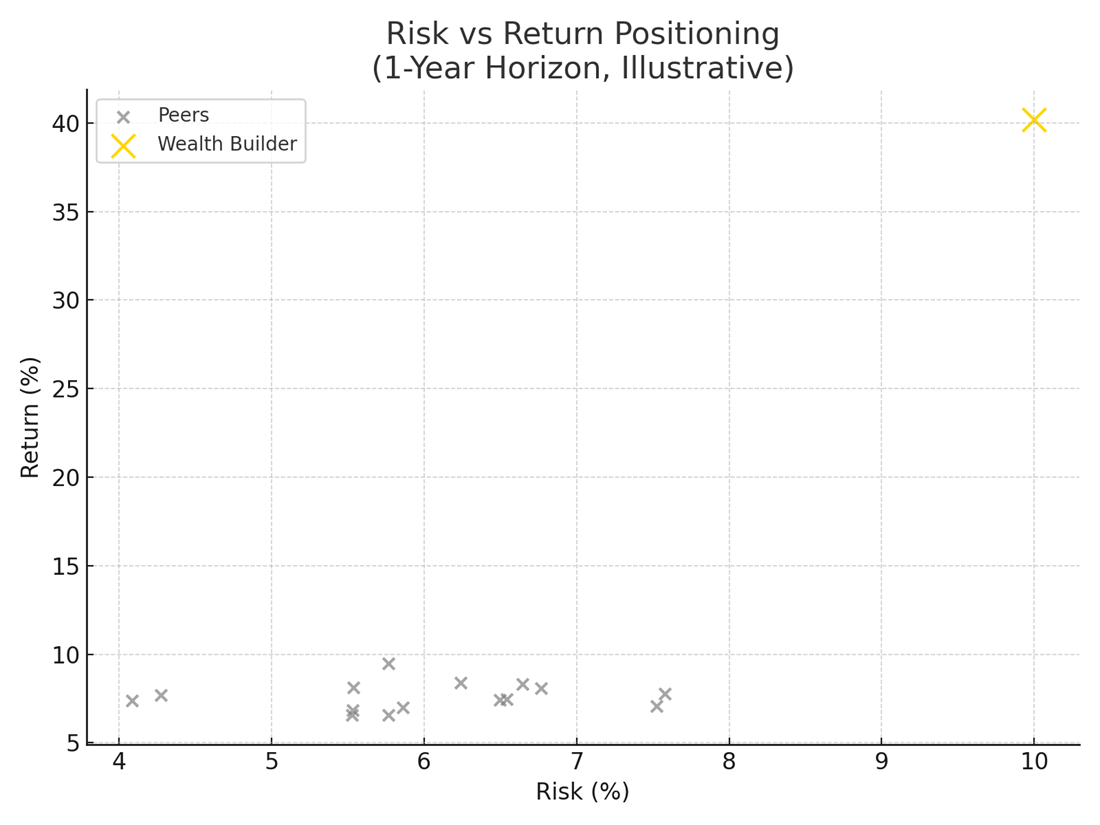

Peer comparisons show most managers clustered tightly together, while Wealth Builder sits well above the group - achieving higher returns, and using our risk budget prudently, but staying well within our mandate parameters.

This differentiation is the result of meaningful dynamic positioning, not incremental tilts.

The Bottom Line

Markets are shifting. Old models are being challenged. Most managers still look the same, but investors don’t need another “me too” portfolio.

Dynamic Asset was built on a different foundation - one that puts goals first, adapts to changing macro conditions and uses the full toolkit to deliver real outcomes.

In short: we changed the playbook. And in a world of inflation, stagflation risk, and geopolitical uncertainty, it’s proving to be the better way forward.

To find out how our range of SMA portfolios and investment strategies can help your advice business manage your client portfolios, contact Dynamic Asset today.