Philosophy Meets Performance

For the past few years, we’ve been saying that traditional strategic asset allocation (SAA) is going to stuggle going forward, and therefore no longer fit for purpose in a world defined by geopolitics, deglobalisation, sticky inflation, and unsustainable debt levels.

The alternative is clear: a Total Portfolio Approach, using Dynamic Asset Allocation (DAA) and active management across a wider toolkit of assets.

The question was always: does it work?

The numbers say yes.

...and, importantly, these results have been achieved during a period of elevated inflation uncertainty, ongoing geopolitical tension, and materially tighter and more volatile financial conditions — an environment where many diversified portfolios have struggled to generate real returns or meaningful diversification.

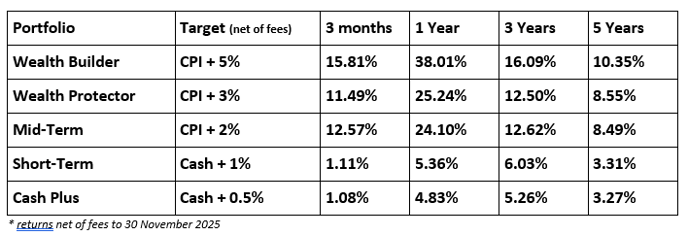

Performance Summary

Our complete range of diversified portfolios have consistently delivered above their objectives across multiple horizons:

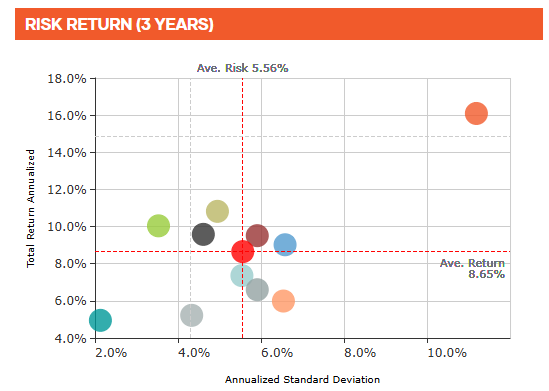

Risk Adjusted Returns: Standing Apart

The risk-return clusters highlight why our approach is different. This separation reflects not incremental tilts, but a structurally different portfolio construction process.

Wealth Builder sits well above the peer cluster, with higher returns. Risk is also higher than peers, but remains well within the risk budget of our mandates. With a Sharpe ratio of 2.13 over 1 year, we’re getting very strong risk adjusted returns. The picture is the same over other time periods.

This separation is the result of meaningful dynamic positioning, not incremental tilts.

Real Differentiation

Correlation analysis tells the same story. Wealth Builder shows only 0.54 – 0.70 correlation with most peers, compared to near 0.9 correlations between the peer group themselves.

That means our portfolios are not just delivering stronger returns — in practical terms, this our portfolios behave differently when markets are stressed — which is precisely when diversification matters most. They are providing something genuinely different.

Why It Worked

- Dynamic Asset Allocation let us pivot into different themes, such as real assets (precious metals, uranium, commodities) and structural trends (resources, defence, technology, energy) when conditions demanded it.

- Absolute, goal-based targets (CPI + X%) kept us focused on delivering real outcomes, not hugging benchmarks or worrying about tracking to peers.

- A broader toolkit meant true diversification, not more “equity beta by another name.”

The Proof is in the Pudding

Many peer portfolios continue to exhibit similar behaviour — highly correlated, benchmark-aware, and constrained in how far they can adapt as conditions change.

Our outperformance is not luck. It’s the direct product of the philosophy we’ve been advocating: forward-looking, flexible, and dynamic portfolio management.

In other words: Philosophy meets Performance

To find out about how our range of adaptive DAA managed account portfolios and how our investment strategies are well suited for today's macroeconomic environment - Contact Us.

Disclaimer

This material has been prepared by Dynamic Asset Consulting Pty Limited (ABN 82 079 145 298, AFSL 502623) of Level 20, 56 Pitt Street Sydney NSW 2000. Any content provided in this Report is for general information purposes only. It is not personal advice and does not take into account the investment objectives, financial situation or needs of any person. Please seek specific advice before making a decision in relation to any investment. Before making any decision about any product you should obtain a Product Disclosure Statement (PDS) or Investment Mandate (IM) document for further information. A copy of our PDS or IM is available from your adviser or by contacting us through our website at www.dynamicasset.com.au