As we move into 2026, the investment world looks materially different from the environment in which Strategic Asset Allocation (SAA) became the dominant portfolio framework.

For much of the past four decades, investors benefited from falling interest rates, contained inflation, stable correlations and broadly predictable policy settings. In that environment, SAA frameworks - built on mean reversion, stable correlations, and historical return patterns - made perfect sense. Advisers were right to rely on it. For a long time, it worked well.

But the investment landscape of 2026 looks fundamentally different. Inflation pressures persist above central bank targets. Geopolitical tensions reshape trade and capital flows. Government debt levels constrain policy responses. Supply chains have fragmented. The equity-bond correlation that provided decades of reliable diversification has become unstable.

The frameworks that worked brilliantly in one regime may need rethinking for another.

When the Framework Changes - Approaches Need to Evolve

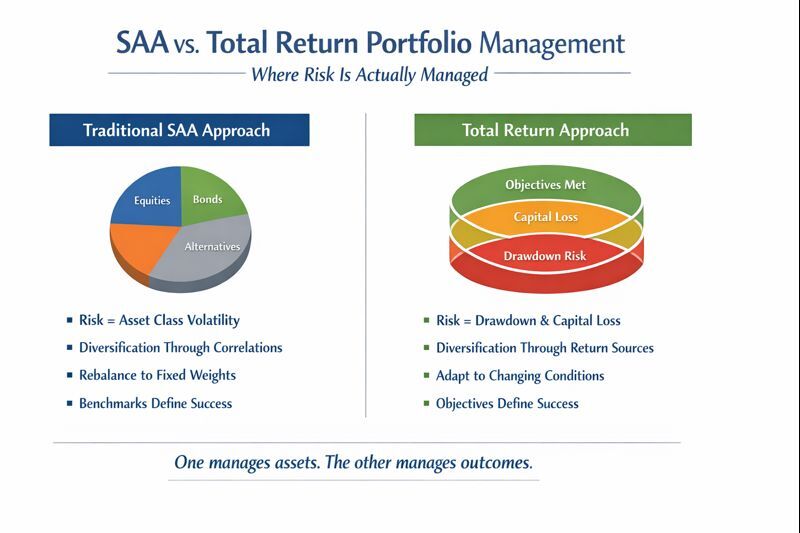

SAA is grounded in long-term historical relationships between asset classes. Its effectiveness relies on relatively stable correlations, mean reversion and a supportive macroeconomic environment. When those conditions hold, diversified portfolios behave largely as expected.

The question advisers are increasingly asking: do the assumptions underpinning traditional SAA still hold in today's environment?

- Correlations have become less stable - The negative correlation between equities and bonds, which provided reliable diversification, has fractured during recent inflation episodes. Both asset classes can decline together when inflation pressures build.

- Policy regimes shift faster - Trade policy, fiscal decisions, and geopolitical realignments can reshape markets materially. Fixed allocations may not adapt quickly enough to these structural changes.

- Historical patterns are less predictive - When structural forces dominate - deglobalisation, energy transition, demographic shifts - past asset class returns become less reliable guides for future performance.

- The toolkit may be too narrow - Traditional equity-bond frameworks exclude asset classes that can provide genuine diversification when conventional assets struggle together.

None of this suggests SAA was wrong. But as times change the question is whether portfolio frameworks should evolve alongside them? Should they reflect a more complex and less predictable environment - one that allows managers flexibility to adapt and current paradigms based on forward-looking decision-making?

The Total Portfolio Approach: An Evolution of Discipline

The Total Portfolio Approach represents an evolution in portfolio management - one that preserves the discipline and rigour of traditional frameworks while adding the flexibility to adapt when investment regimes shift.

Rather than replacing SAA, TPA builds on its foundations with four key enhancements:

1 - Focus on client objectives, not just benchmarks

TPA measures success by whether clients achieve their real-world goals - capital preservation, income generation, inflation-beating returns - rather than purely relative performance. A portfolio that loses less than its benchmark still loses. TPA aims for positive outcomes regardless of what markets do.

2 - Manage the whole portfolio holistically

Instead of managing asset classes in silos, TPA evaluates every investment based on its contribution to total portfolio risk and return. Capital flows to where opportunities are strongest and risks most manageable, unrestricted by traditional asset class boundaries.

3- Adapt dynamically to changing conditions

When macro conditions, policy regimes, or market structures shift materially, TPA portfolios can adjust allocations accordingly. This isn't market timing - it's regime recognition. When the investment landscape changes, portfolios can evolve rather than remain anchored to assumptions that may no longer apply.

4- Access a broader investment toolkit

TPA portfolios can access commodities, infrastructure, real assets, currency strategies, and absolute return alternatives as core allocations. This expanded opportunity set provides genuine diversification when traditional assets move together - which increasingly, they do.

How TPA Adds Value in Today's Environment

The investment environment ahead could take many forms - persistent inflation, deflationary pressures, continued volatility, or scenarios we haven't yet imagined. What's certain is that regime uncertainty will persist. TPA's adaptive framework provides flexibility across scenarios:

- If inflation persists - TPA can rotate into real assets, commodities, and inflation-protected securities while reducing exposure to assets that typically struggle in inflationary environments.

- If growth slows materially - TPA can access defensive alternatives and reduce equity exposure before valuations compress, rather than simply rebalancing back into declining markets.

- If geopolitical tensions escalate - TPA can reduce exposure to affected regions and sectors, accessing alternatives that provide genuine portfolio protection.

- If conditions stabilise - TPA can increase exposure to growth assets when opportunities become compelling, capturing upside while managing downside risks.

The key is having a framework that can respond rather than one that assumes conditions will mean-revert to historical norms.

Evidence from 2025

Theory matters, but results matter more. Over the course of 2025, our diversified portfolios - managed using a Total Portfolio Approach - delivered exceptional full-year outcomes across both growth-oriented and more defensive objectives.

For example: our Wealth Builder portfolio returned 45.60% over the year, while Wealth Protector delivered 30.35%.

Importantly, these results were achieved during a period of elevated inflation uncertainty, ongoing geopolitical tension, and materially tighter and more volatile financial conditions – an environment in which many diversified portfolios struggled to generate real returns or meaningful diversification.

Beyond absolute returns, the quality of those outcomes also matters. Over the same period, Wealth Builder delivered a Sharpe ratio of 2.61, well above peer medians, while Wealth Protector also achieved strong risk-adjusted outcomes within its defined risk budget. Correlation analysis shows that our portfolios exhibited materially lower correlation to traditional portfolio managers (correlation: 0.5 - 0.7), which tended to cluster closely together.

In practical terms, this meant our portfolios not only delivered higher returns, but did so with diversification benefits that showed up when markets were under stress, which is when diversification matters most. This differentiation isn't incremental improvement. It's structural differentiation from accessing a broader opportunity set and managing it dynamically.

Institutional Thinking, Made Accessible

Large institutional investors such as Australia’s Future Fund and leading global endowments have long recognised the need for adaptable portfolio frameworks, moving beyond rigid strategic allocations to manage more complex market regimes.

Future Fund Chairman, Peter Costello, noting the changing investment environment, stated: "The world is moving… The board's got to be on top of its game to be ready for that."

What has changed is accessibility. Approaches once reserved for institutions are now available to advisers through professionally managed, retail-accessible portfolio solutions.

Looking Ahead to 2026 – The Questions Worth Asking

The outlook for 2026 and beyond is unlikely to resemble the stable, disinflationary period that supported traditional portfolio construction for decades. Growth may continue, but volatility, policy intervention and shifting market leadership are likely to remain features of the landscape.

In this context, advisers might consider whether their current portfolio solutions are positioned for the range of potential outcomes:

- Can your portfolios adapt materially if the investment regime shifts - or are they locked into fixed allocations regardless of changing conditions?

- Do they access a genuinely broader opportunity set that can provide real diversification when traditional assets struggle together?

- Will they behave differently from the market when that differentiation matters most - during periods of stress?

- Have they delivered the kind of differentiated results shown above - not just in theory or back tests, but in live client portfolios through actual market volatility?

These aren't criticisms of existing approaches. They're questions about whether portfolio frameworks designed for one era remain optimal for another.

Evolution, Not Revolution

The Total Portfolio Approach doesn't reject the principles that made SAA successful. It preserves the discipline, rigour, and long-term focus that have always mattered in portfolio management. What it adds is the flexibility to adapt when structural forces create sustained divergence from historical patterns.

For advisers, the challenge is not abandoning proven principles, but evolving them. SAA has served investors well. The task now is ensuring portfolio frameworks continue to serve clients just as effectively in a very different investment environment.

A Total Portfolio Approach, supported by Dynamic Asset Allocation, offers a framework better aligned with today’s realities and more adaptable to the decade ahead.

To find out about how our range of adaptive DAA managed account portfolios and how our investment strategies are well suited for today's macroeconomic environment - Contact Us.

Disclaimer

This material has been prepared by Dynamic Asset Consulting Pty Limited (ABN 82 079 145 298, AFSL 502623) of Level 20, 56 Pitt Street Sydney NSW 2000. Any content provided in this Report is for general information purposes only. It is not personal advice and does not take into account the investment objectives, financial situation or needs of any person. Please seek specific advice before making a decision in relation to any investment. Before making any decision about any product you should obtain a Product Disclosure Statement (PDS) or Investment Mandate (IM) document for further information. A copy of our PDS or IM is available from your adviser or by contacting us through our website at www.dynamicasset.com.au